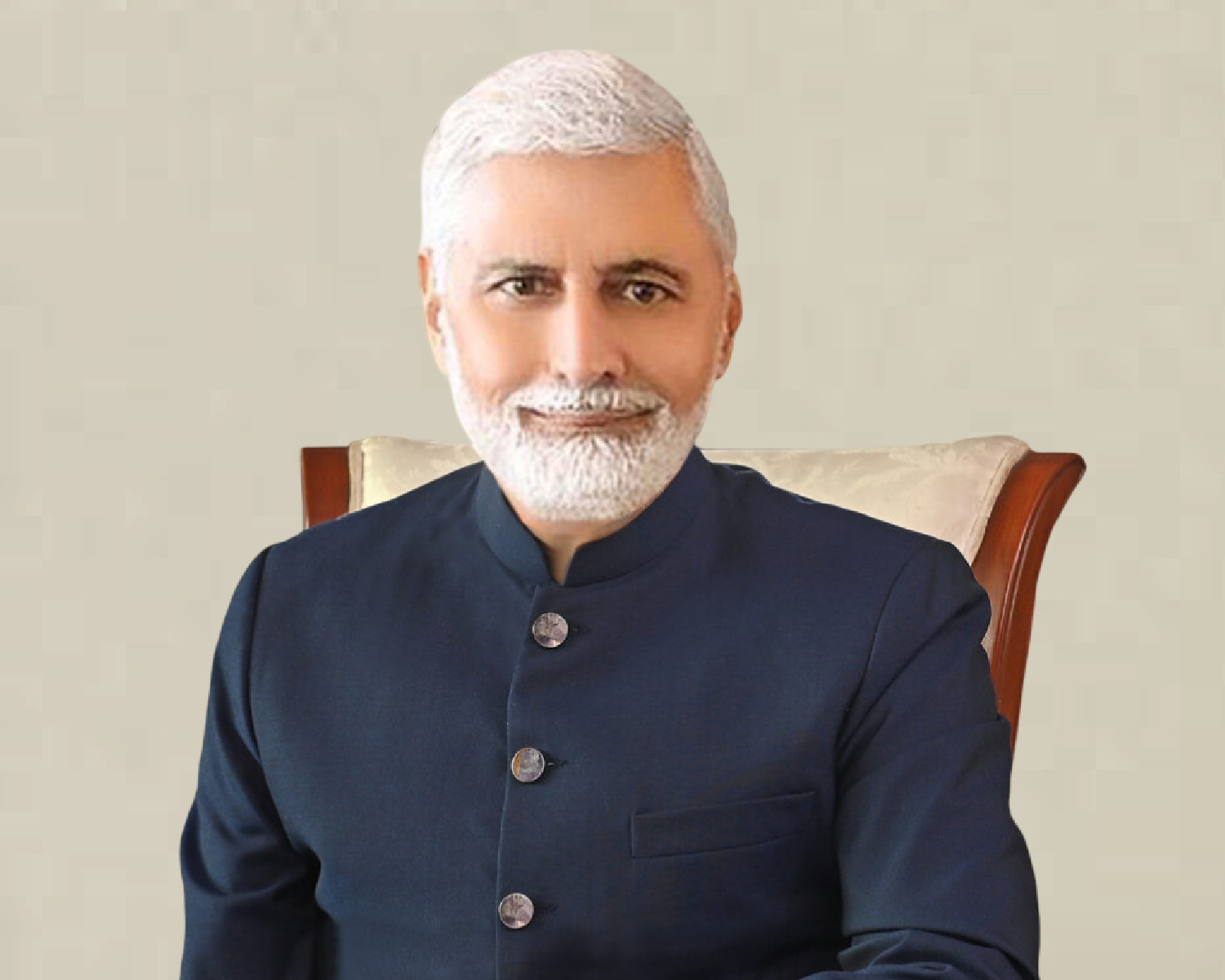

Syed Omair Ahmad Bokhari is a seasoned technology and finance leader with a unique blend of expertise in Chartered Accountancy and digital transformation. As CIO of Fatima Group, he has spearheaded numerous digital transformations cloud migrations, and enterprise-wide IT initiatives, bridging the gap between financial rigor and technological innovation. With leadership programs from Harvard, Stanford and LUMS under his belt, Omair brings a global perspective to driving change in complex business environments.

Q1: You started your career as a Chartered Accountant and then grew into ERP and digital transformation leadership. How did this journey unfold, and what kept you motivated to bridge finance with technology?

My career began in finance, where precision and compliance were paramount. As a Chartered Accountant, I quickly realized that technology was becoming the backbone of financial efficiency and strategic decision-making. The turning point came when I was involved in ERP implementations early in my career, I experienced that how technology could transform not just the processes but entire business models.

What kept me motivated was the ability to bridge two worlds: the rigor of finance and the agility of technology. This intersection allowed me to deliver solutions that were not only technically sound but also financially viable, ensuring that transformation initiatives created measurable business value.

Q2: Having delivered more than 20 full-cycle ERP implementations, what has been your most challenging project from both an IT and finance perspective and what lessons did it teach you?

One of the most challenging projects was a multi-entity ERP rollout across geographically dispersed operations. The complexity wasn’t just technical, it was cultural and operational, too. Aligning diverse business units under a unified process framework required strong governance and relentless stakeholder engagement.

The biggest lesson? Technology alone doesn’t drive transformation, people do. Success depends on change management, clear communication, and ensuring that every stakeholder understands the “why” behind the change. It taught me that empathy and adaptability are as critical as technical expertise.

Q3: Many organizations struggle to quantify the ROI of digital transformations. In your view, how can finance leaders ensure that digital transformation truly adds financial value?

ROI in digital transformation is often misunderstood because benefits extend beyond direct cost savings. Finance leaders should adopt a value-based approach, measuring improvements in process efficiency, decision-making speed, compliance, and scalability.

Key steps include:

•Define KPIs upfront (e.g., reduction in closing cycle, inventory accuracy, working capital optimization).

•Track adoption metrics because unused features equal wasted investment.

•Link outcomes to strategic goals. It should enable growth, not just automate tasks.

•Ultimately, ERP or other systems are enablers of agility and resilience, which translates into long-term financial value.

Q4: Beyond ERP and applications, you have overseen PMO functions for large-scale IT initiatives. What role does a strong PMO play in ensuring governance, accountability, and alignment with business strategy?

A strong Project Management Officer (PMO) acts as the nerve center of transformation. It ensures that projects are not just delivered on time and budget but also aligned with strategic objectives. Governance frameworks, risk management, and stakeholder reporting are critical functions.

In my experience, PMOs also drive transparency and accountability, enabling leadership to make informed decisions. They create a culture of discipline without stifling innovation, a balance that is essential for large-scale initiatives.

Q5: With cybersecurity becoming a board-level concern, how do you balance the need for innovation with the responsibility of securing data, ensuring compliance, and managing cyber risks?

Innovation and security are not opposing forces. They must coexist. My approach is “secure by design” embedding security protocols into every stage of technology adoption.

This includes:

•Continuous risk assessments aligned with regulatory frameworks.

•Zero-trust architecture for data protection.

•Employee awareness programs, because human error is often the weakest link.

•Boards appreciate when cybersecurity is positioned as a business enabler, not just a compliance checkbox.

Q6: Infrastructure often works behind the scenes but is critical for reliability and scalability. What are some of the key infrastructure challenges you’ve faced, and how have you addressed them?

Scalability and resilience have been recurring challenges, especially during cloud migrations and hybrid deployments. Legacy systems often resist integration, creating bottlenecks.

We addressed these by:

•Adopting cloud-first strategies for agility and using latest upgraded versions for on-prem solutions.

•Implementing robust monitoring tools for proactive issue resolution.

•Standardizing architecture to reduce complexity.

•Infrastructure may be invisible, but its impact on business continuity is undeniable.

Q7: With your experience in Oracle Cloud SaaS and other enterprise platforms, what emerging technologies are you most excited about for reshaping financial and operational management?

I am particularly excited about AI-driven initiatives and predictive insights. These tools are transforming finance from a backward-looking function to a forward-looking strategic partner.

Other areas include:

•Analytical AI, Gen AI and its integration into workflows.

•Hyper-automation to eliminate repetitive tasks

Q8: Beyond technology, leadership and change management define the success of transformation. How do you keep teams aligned, motivated, and future-ready during demanding projects?

I believe in purpose-driven leadership. Teams stay motivated when they understand the impact of their work on the organization’s vision.

My approach includes:

•Clear communication of goals and milestones.

•Empowering decision-making at all levels.

•Continuous learning opportunities, so teams feel future-ready.

•Transformation is a marathon, not a sprint; keeping morale high is as important as meeting deadlines.

Q9: Looking at the broader finance profession, how do you see the role of Chartered Accountants evolving in an increasingly digital and data-driven business environment?

Chartered Accountants are no longer just custodians of compliance; they are becoming strategic advisors. With automation handling routine tasks, the focus shifts to data analytics, risk management, and business partnering.

Future-ready finance professionals must embrace technology, understand digital ecosystems, and leverage insights for strategic decision-making.

Q10: On a personal note, you have attended leadership programs from Harvard, Stanford, LUMS, and others. Which of these experiences had the biggest impact on your leadership style and professional philosophy?

Harvard’s leadership program was transformative; it emphasized adaptive leadership and the ability to navigate complexity. It taught me that leadership is less about authority and more about influence, empathy, and resilience.

Stanford was one of its kind. AI leadership and how we can integrate it into daily workflows.

LUMS reinforced the importance of contextual intelligence, understanding local dynamics while thinking globally. These experiences shaped my philosophy: lead with purpose, adapt with agility, and never stop learning.

Q11: Outside of your professional achievements, what personal principles or habits have guided you through the highs and lows of such a dynamic career?

Three principles guide me:

•Integrity; because trust is the foundation of leadership.

•Continuous learning; staying curious keeps you relevant.

•Resilience; embracing challenges as opportunities for growth.

I also practice structured reflection—taking time to evaluate decisions and learn from outcomes. It’s a habit that has served me well in both personal and professional spheres.

Digital transformation is not just about technology, it’s about people, processes, and purpose. My journey from finance to technology has taught me that the future belongs to those who can bridge disciplines, embrace change, and lead with vision. As businesses navigate disruption, the ability to combine financial acumen with technological foresight will define the leaders of tomorrow.